Unearth your next Unicorn with Growthsphere

The Challenge You Face

If you're not moving at market speed, you've already lost

While you’re manually evaluating deals the fastest-moving funds are going from initial contact to term sheet in under six weeks.

How Growthsphere Helps

Real-world use cases for deal sourcing and investment analysis

Instantly transform a pitch deck or company website into a diligence memo. Use domain-specific AI to automatically score and rank inbound opportunities against your mandate so your team focuses on high-potential deals.

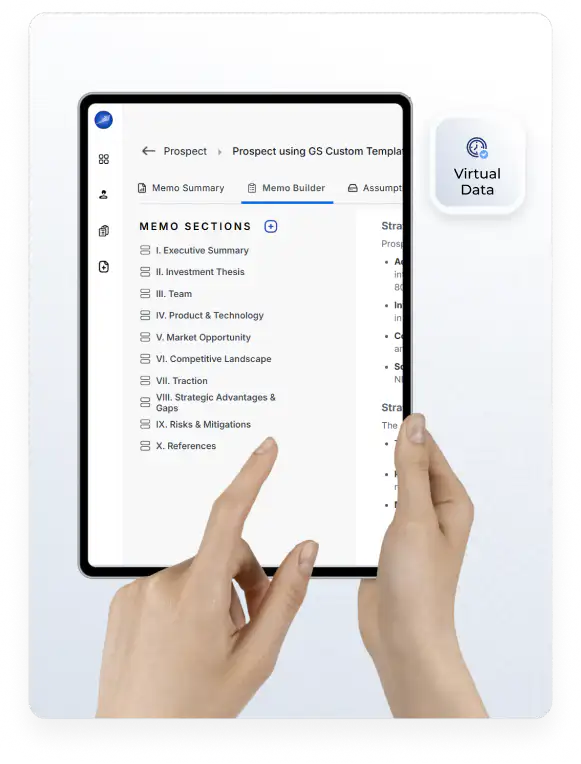

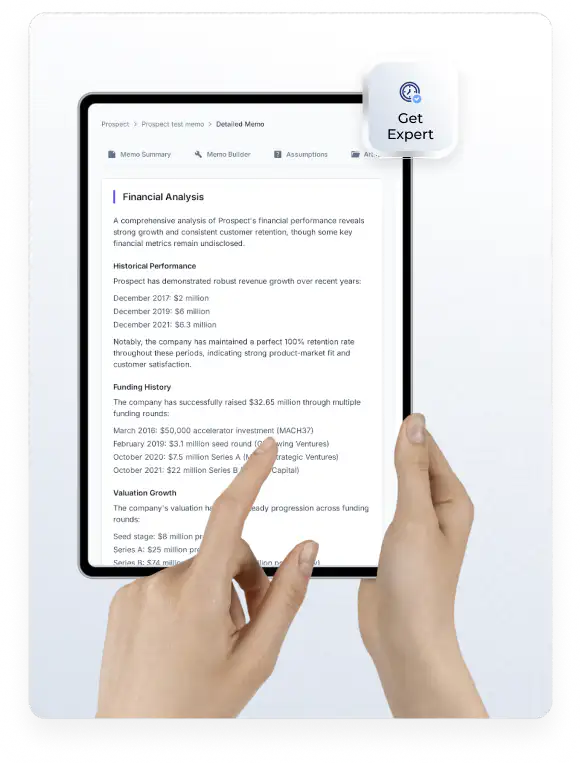

Move from screening to building a full memo ready for your investment committee. Ingest an entire virtual data room (VDR) and use agentic models to analyze financials, identify risks, and validate results.

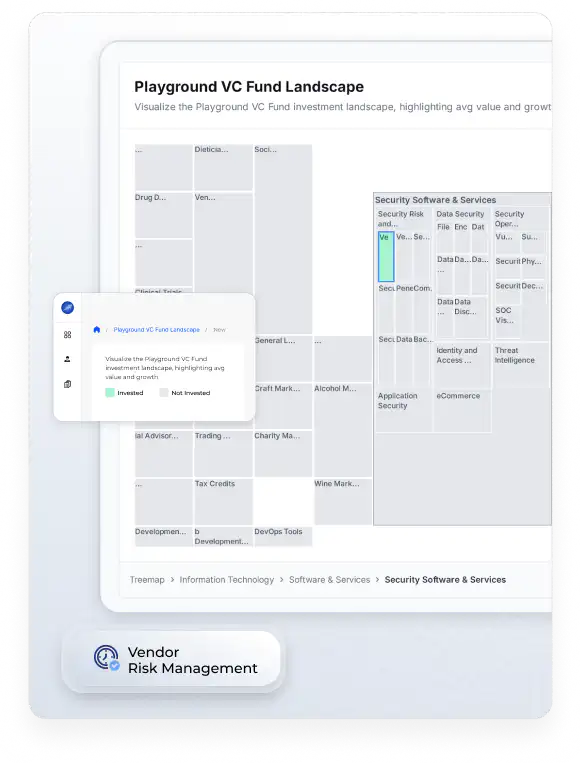

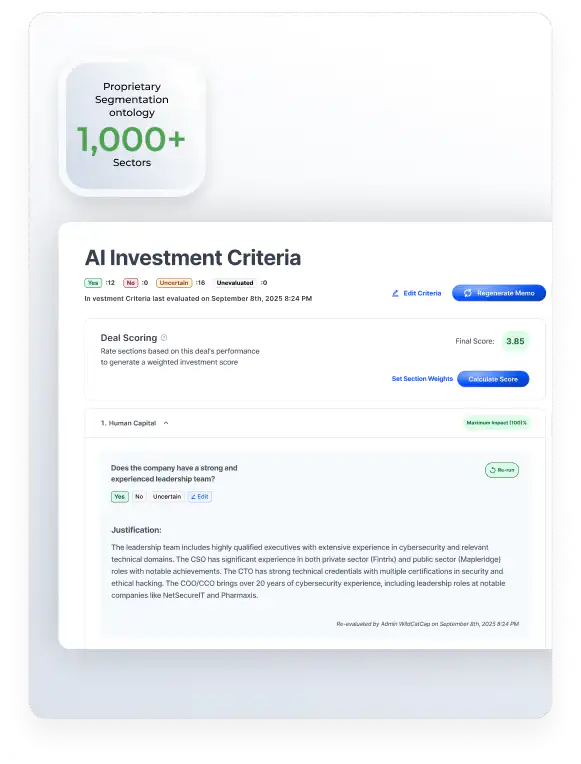

See where investment opportunities exist using our proprietary segmentation ontology that covers 1,000+ sectors compared to standard GICS’s 300. Identify which sectors your portfolio lacks and where market concentration risks exist.

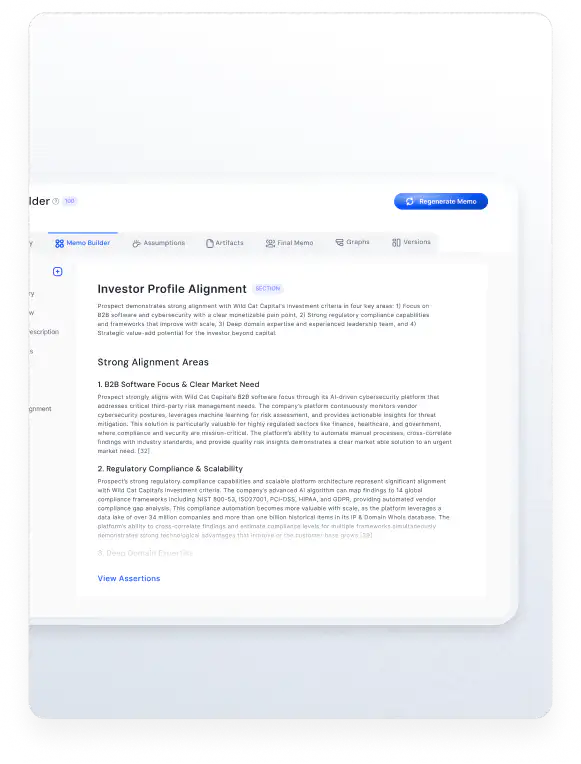

Set up your Investor Profile, Investment Criteria Checklist, and Template Library. Evaluate deals against your fund’s actual investment criteria using our personalized reasoning models along with weighted scoring to stack-rank your pipeline.

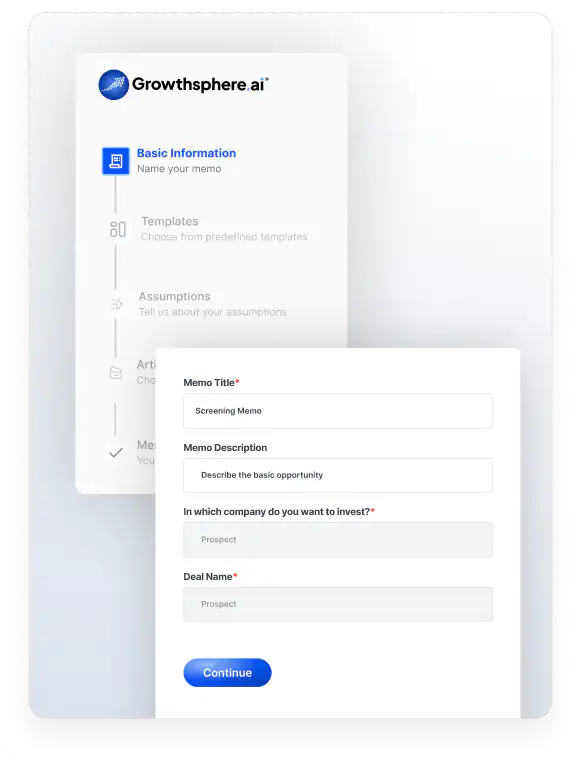

Generate comprehensive screening memos in minutes leveraging our proprietary sector ontology and personalized reasoning models. Automatically collect market and competitor data to quickly evaluate deals and decide where to spend more time.

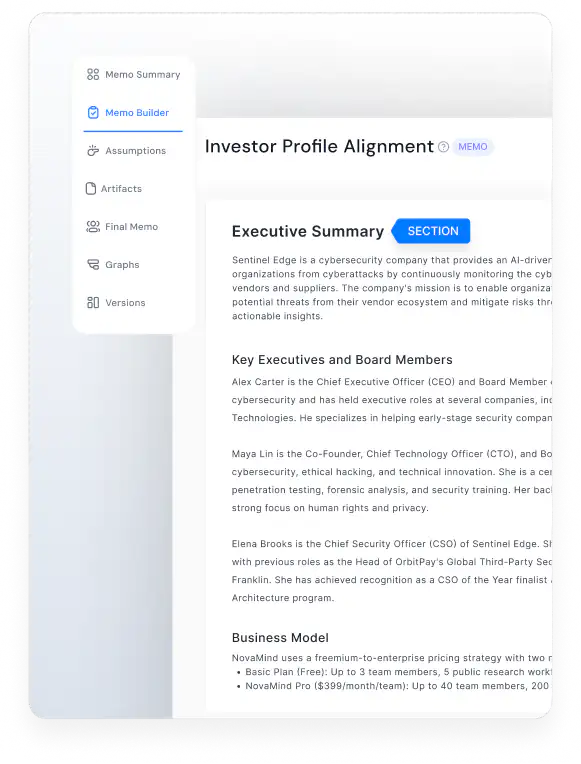

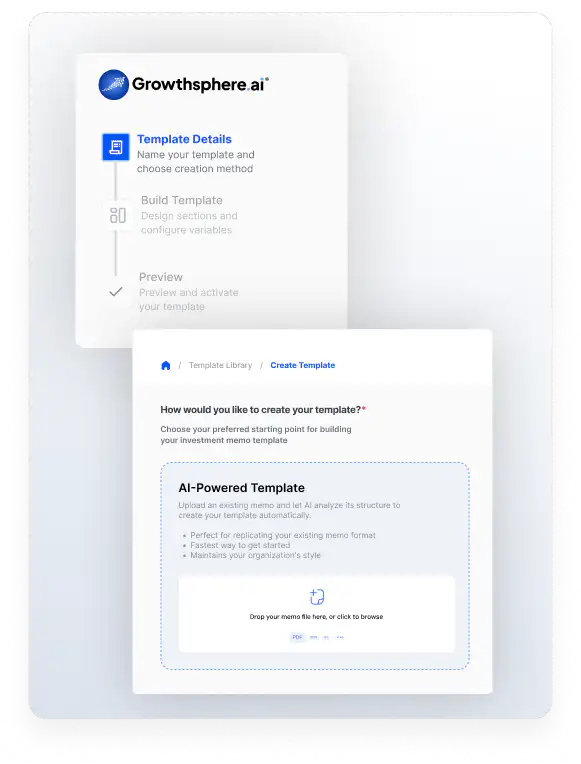

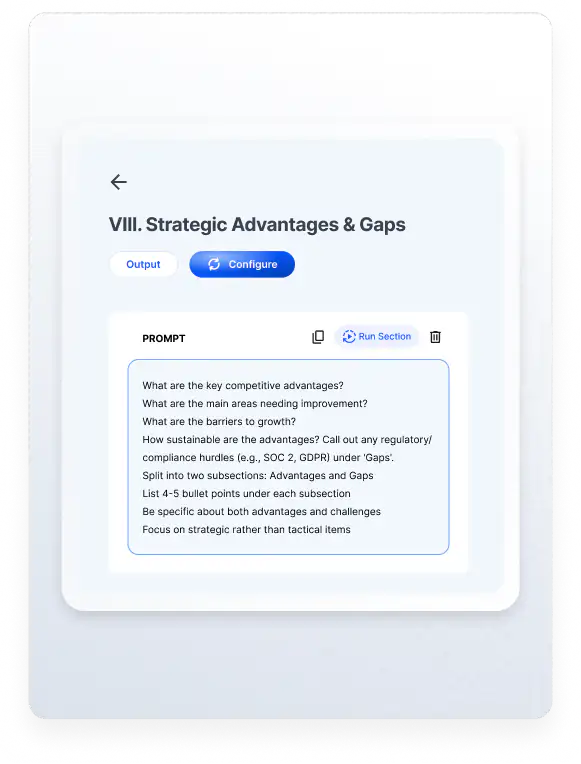

Upload your IC memo once and watch our Template Library auto-generate all the prompts. Memo Builder organizes data room documents, extracts key information, and lets you customize components from our Library.

AI agents handle specific tasks like company valuations, risk assessments, and team evaluations. Each agent follows your fund’s specific methodologies and benchmarking standards.

Ask “What’s the revenue growth compared to similar companies?” Get instant answers from comparable company analysis and financial models. No more wrestling with pivot tables or waiting for analysts to run comps.

Generate quarterly LP reports automatically by pulling data from your portfolio systems and fund administrator, presenting it in consistent formats that meet compliance requirements.