AI that closes M&A deals like your best analyst

The Challenge You Face

The M&A bottleneck:

When process kills deal velocity

But with market maps and stakeholder inputs shifting weekly, you're left with no predictable path.

The Growthsphere Difference

AI-powered use cases to accelerate your M&A pipeline

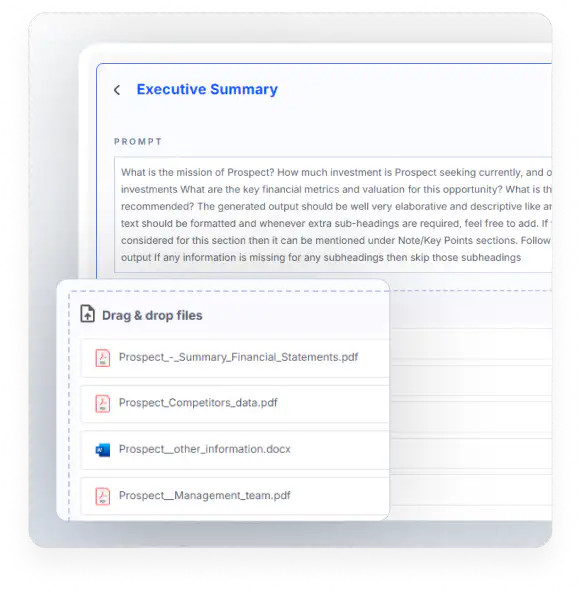

Instantly transform a pitch deck or company website into a diligence memo. Use domain-specific AI to automatically score and rank inbound opportunities against your mandate so your team focuses on high-potential deals.

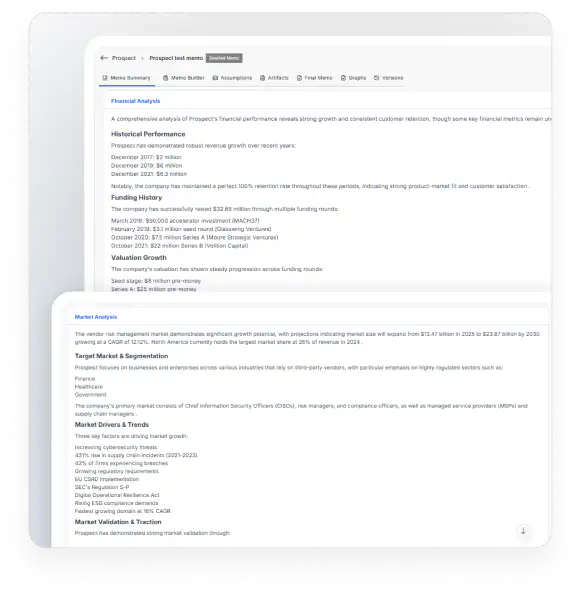

Move from screening to building a full memo ready for your investment committee. Ingest an entire virtual data room (VDR) and use agentic models to analyze financials, identify risks, and validate results.

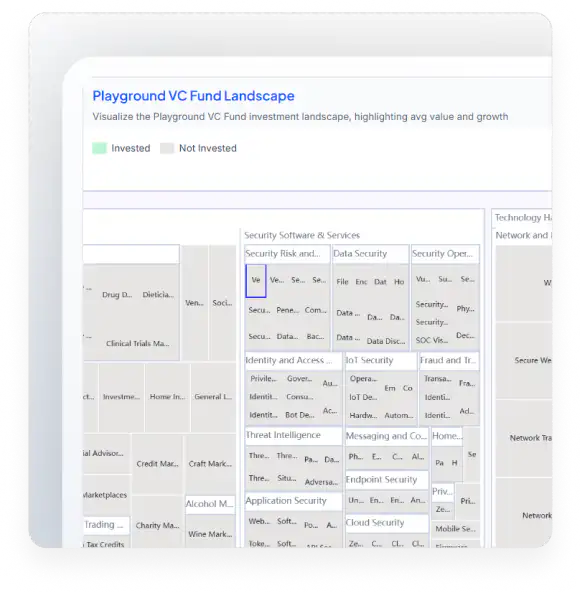

Go beyond reactive deal flow. Use Growthsphere’s proprietary sector ontology to identify “white space” opportunities and build a pipeline of targets in strategic sectors that align with your company’s growth objectives.

Maintain a real-time, data-driven view of your existing acquisitions. Model the strategic and financial impact of a new acquisition on your current business units and track post-merger integration progress against key metrics.

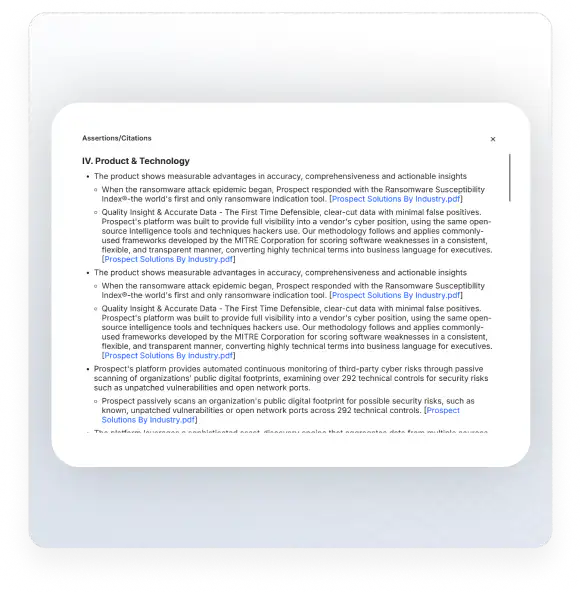

Generate consistent, board-ready reports and memos automatically. With every data point and insight linked to its source, present to your investment committee and board with complete confidence and a fully auditable trail.