Memo as a Service

Your Data. Your Assumptions.

Our AI-Enabled Investment Decisions.

Growthsphere’s Memo-as-a-Service supports your fund across the pre, during, and post investment lifecycle by generating memos that reflect your actual investment logic.

See MaaS in Action

WHY MaaS EXISTS

Our Reasoning Models are Generating Memos

for Companies and Funds

Most AI platforms produce memos without applying your actual investment beliefs—your risk tolerance, sector focus, or decision framework. MaaS is different. It translates your assumptions, criteria, and fund profile into structured outputs that reflect how you truly invest.

See MaaS in Action12+

Early VC

2+

Late VC

1

Family Office

1

Corp Dev

WHAT MaaS DOES

Generate Memos Based on Your Investment Criteria

Structured Investment Thinking

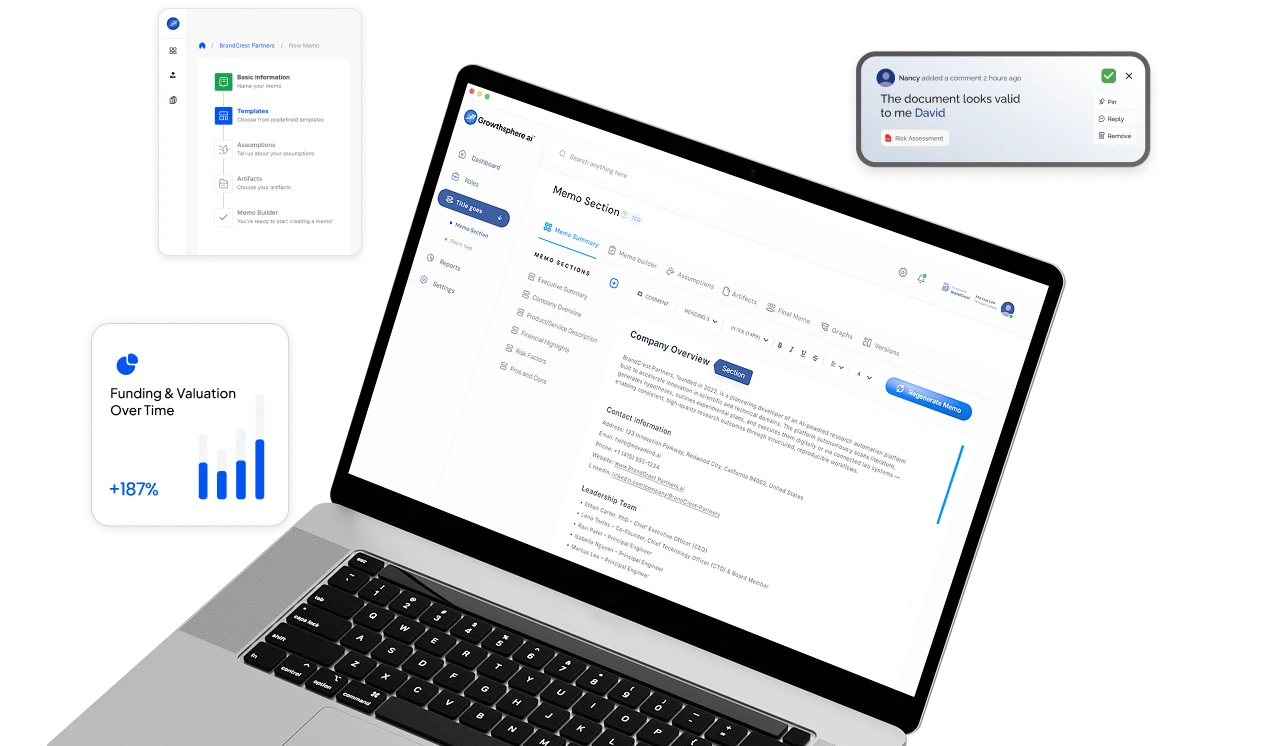

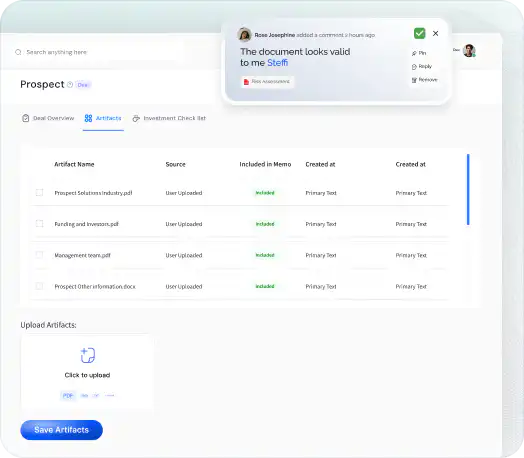

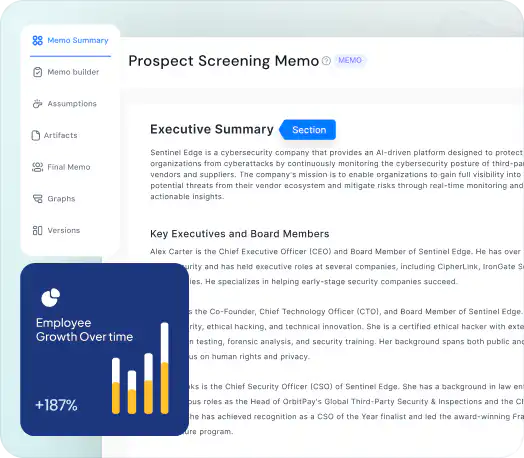

MaaS applies your fund’s logic through personalized reasoning models for consistent decision-making with every memo. When data is unclear, analysts review flagged sections to preserve oversight.

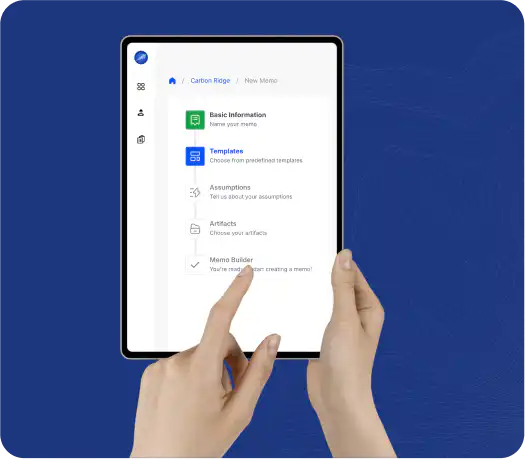

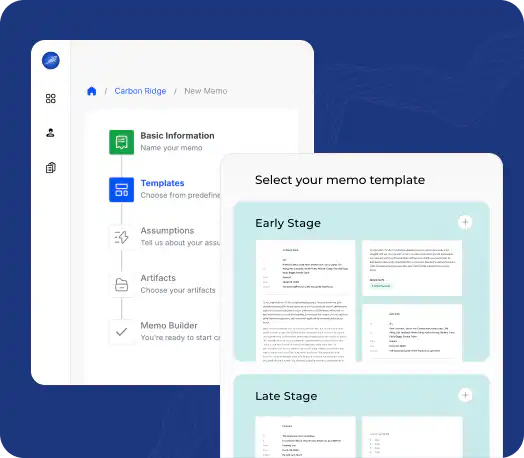

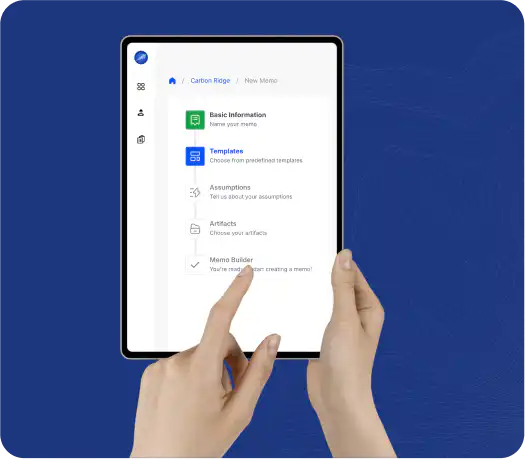

Custom Memo Templates

MaaS supports customizable templates based on your fund’s preferred memo structure. Each template includes pre-loaded prompts and editable sections, helping analysts structure memos consistently while tailoring them to sector, stage, and strategy.

PitchBook + Web Data

Our analyst team curates and validates company, funding, and market data from PitchBook and public sources. That information is then structured for memo generation, so analysts start with context that’s accurate, relevant, and decision-ready.

Company Segmentation Ontology

Companies are mapped to sectors, peers, and business models using Growthsphere’s proprietary segmentation ontology built to reflect how institutional investors evaluate private markets. The system improves over time based on analyst input and fund-specific usage.

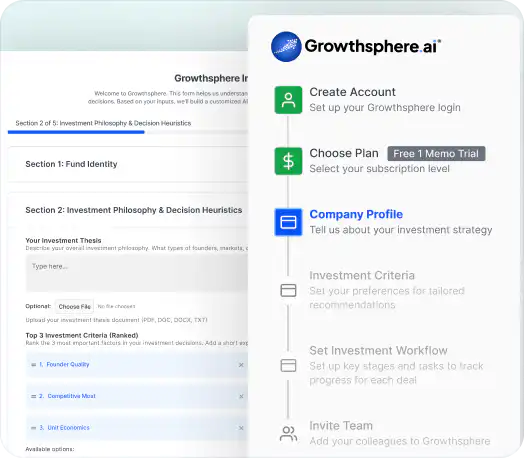

Investor Criteria and Profiling

MaaS builds a profile of your fund through a fine-tuning loop, capturing your risk profile, strategic goals, and decision-making framework. Analysts and AI work together to train the system, so memos reflect how your team truly invests.

Automated Memo Generation

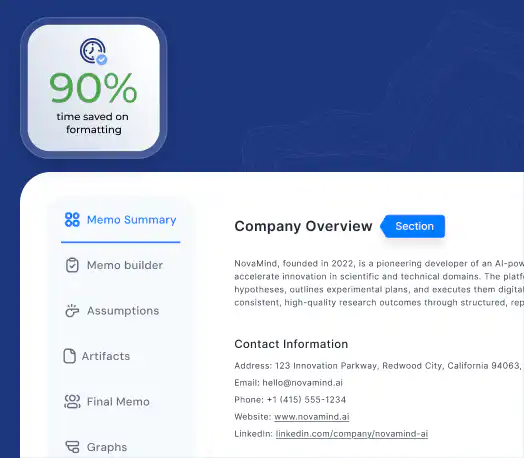

Starting with as little as a company name, website, or extensive data room, MaaS automatically composes polished memos, accelerating due-diligence workflows and standardizing documentation for stakeholders.

THE MaaS EDGE

Our Personalized Reasoning Models Think like an Investor

and Follow Your Fund’s Investment Strategy

Criteria-Based Screening

with Minimal Input Data

AI-Augmented Diligence

& IC Memo Creation

Enable

Co-Investing

Originate Deals that

Match Your Criteria

Liquidity for Your

Portfolio Companies

LP Reporting & Portfolio Analysis

Who can use MaaS?

MaaS Supports Diverse Investors with Strategy-Aligned Decision-Making Artifacts

WHO CAN USE MaaS?

MaaS Supports Multi-Stage Investors Leveraging Their Own Investment Strategies

Investment-Grade

Memos Ready in Hours,

Not Weeks

See The Demo