Institutional Product

Unlock the Power of Our Product Across All Asset Classes.

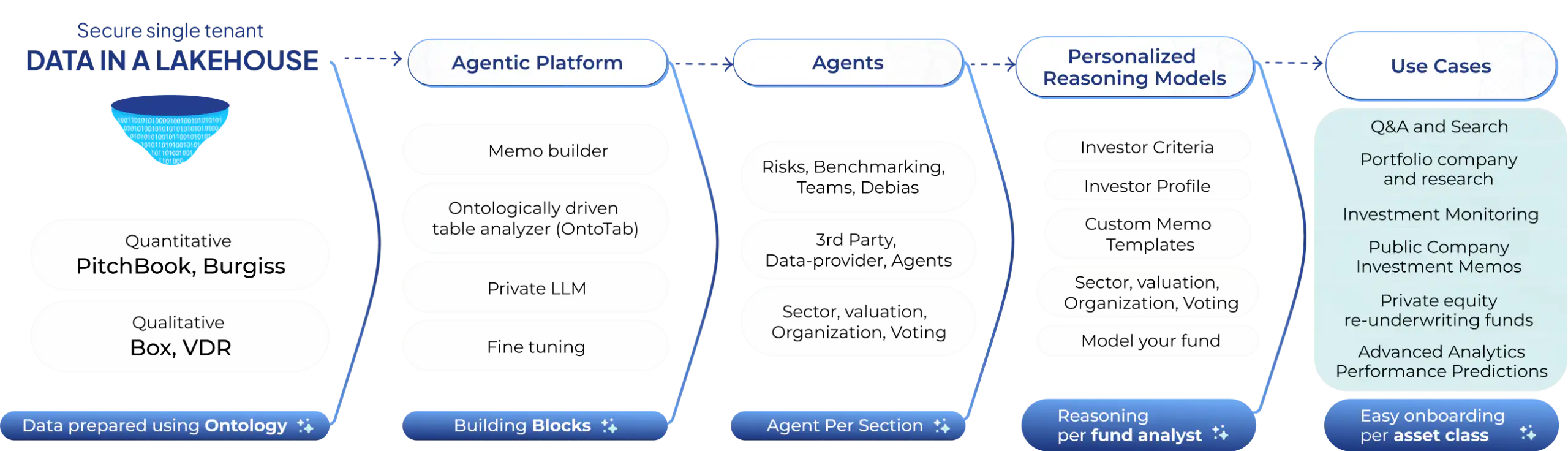

Growthsphere enables fund-specific decision making using ontological reasoning, specialized AI agents operating on numerical data, fine-tuning, explainability and comprehensive data integration in order to address the limitations in institutional investing.

Request a Demo

Pension Funds

UC

Investments

$1

Trillion

Large Educator’s Pension Fund

One of Canada’s largest public sector pension funds.

Reasoning across asset-classes with high privacy

Our Institutional Product Thinks like an Investor

We incorporate investment criteria, investor profile, templates, and assumptions. So, every use case is fund-specific and can operate on quantitative and qualitative data.

Data & Analytics Retrieval

Enable your team to query portfolio metrics, benchmarks, and attribution data across markets using natural language. We translate questions into structured queries, generate charts, and summarize results, making it easier to act on performance across multiple asset classes.

Investment Monitoring

With our Ontology driven table analyzer (OntoTab) we track performance across private and public investments as new data becomes available. We synthesize quarterly letters, extract financials and flag deviations in exposures or assumptions, so your team gets a running view of every manager and mandate.

PE Co-Investment & PE Co-Investment Memos

Generate insightful co-investment and re-underwriting memos grounded in your data, assumptions, portfolio and risk profile. We pull data from databases, investment book of records and web searches to produce structured drafts, reflecting your firm’s risk horizon and decision methodologies.

Q&A and Search Across Investment Artifacts

Structured Knowledge Capture

We encode your investment logic, assumptions, and decisions as structured data using proprietary ontologies. These include company segmentation, alternative performance, and company fundamentals, so knowledge compounds, decisions stay traceable, and teams reason from the same foundation.

Public Equity Memos

Support active public equity decisions with AI-generated memos that reflect your internal framework. We back-test ideas, encode assumptions, analyze factor exposures, and log post-mortems, creating a consistent audit trail from conviction to outcome.

Fine-Tuning and Training

Our models are trained using a fund’s historical memos, investment committee materials, emails, and research notes, then fine-tuned for their terminology, assumptions, and template structure. We support reasoning across new investments, portfolio monitoring, or re-underwriting decisions.

Entitlement Security

Large funds have privacy and data access rules within the fund. For example, an impending funding or company purchase artifacts is only visible to deal team and decision maker.

Advanced Analytics & Performance Prediction

Flag early signals and run predictive performance analyses across funds and companies. We blend qualitative tone analysis with quantitative trend modeling to identify emerging risks, performance drift, or anomalies, helping teams course-correct before issues escalate.

Who is Growthsphere for?

Institutions choose Growthsphere to Invest without Compromising Quality, Security, or Oversight

Funds

Equity

Wealth Funds

For institutional investors who need to make accurate, fast, and fund-specific decisions

See The Demo

How We Think About Investing

Everything You Need to Know About Personalized Reasoning Models for Institutional Investing

See all posts

December 17, 2025

Private LLMs for Institutional Investing: From “Tenant” to Owner

Why institutional investors and private equity firms should consider deploying…Read more

July 9, 2025

Ontological Reasoning: Key to Personalized Reasoning

A new technique for screening memos for early-stage deals AI…Read more

July 1, 2025

Building AI That Actually Thinks Like Investors

It has been some time since we started building Growthsphere…Read more

How We Think About Investing